Launch Your Wealth Plan With Our New Client Promotion

A Gold IRA provides unmatched stability during financial crises. Fortify your retirement with a gold IRA.

- Free 5 Gram Gold Bar with $10,000+ Purchase

- Free Safe for Qualified At-Home Purchases

- Free IRA Accounts and 5 Years of Secure Metal Storage

100K

Satisfied customers

30 +

Years of experience

$3 Billion+

Total Client Assets Transferred

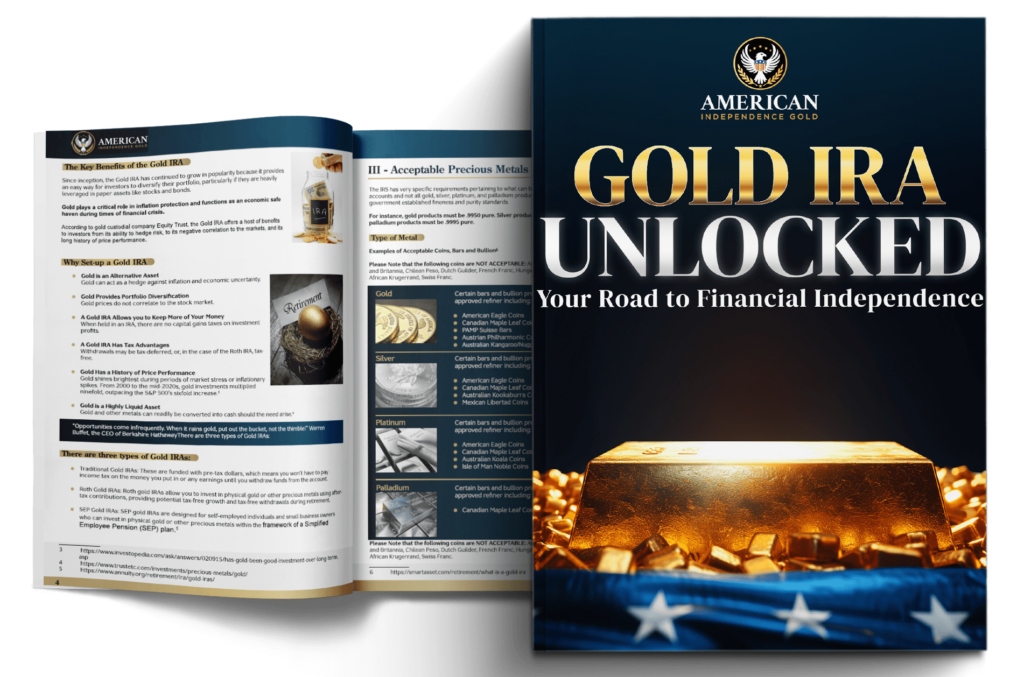

Request your

FREE Gold Information Kit

As Featured in

More Than a Name—

A Commitment to Your Future.

At American Independence Gold, your financial security is our priority. We safeguard your investments with the utmost care at the Delaware Depository, known for its stellar security and compliance. Partnering with The Entrust Group, our trusted custodian, we ensure your Gold IRA is managed with precision and expertise.

How to Open Your Gold IRA Account with Ease

Step 1

Contact Us

Call (833) 324-4653. Our IRA team will guide you through submitting an application with our trusted custodians, ensuring regulatory compliance.

Step 2

Transfer Funds

Our team assists in a seamless, tax-free transfer of your retirement funds to your new account.

Step 3

Purchase Metals

Once funded, work with a Metals Director to select Gold, Silver, Platinum, or Palladium, securely stored at Delaware Depository with $1 billion insurance.

Precious Metals Performance in Times of Economic Crisis

Crisis Year

Gold (%)

Silver (%)

Dow Jones (%)

2020 Pandemic Recession

+24%

+47%

-23%

2011 Debt Ceiling Crisis

+32%

+85%

-17%

2008 Financial Crisis

+25%

+30%

-34%

2001 Dot-Com Crash

+18%

+28%

-16%

These trends highlight how Gold and Silver IRA investments offer strong growth potential during economic crises, while traditional markets like the Dow Jones experience significant losses.

Frequently Asked Questions

We understand that securing your financial future is a significant decision, and you may have questions about how a Gold IRA can help. In this section, we’ve answered the most common questions to provide clarity, confidence, and peace of mind as you explore the benefits of investing in precious metals.

Where is the gold stored in a Gold IRA?

What is a Gold IRA and how does it differ from a traditional IRA?

How do I Get Started with a Gold IRA?

What are the tax Advantages of a Gold IRA

What are the costs associated with a Gold IRA

Download Your Free Gold & Silver Investment Guide

Learn how precious metals can protect and grow your wealth. Get expert insights on starting a Gold IRA today!

Copyright © 2022-2023 American Independence Gold. All rights reserved.